Are you worried about Delivery Hero’s recent plan to sell Yogiyo? Then, find out how this move affects the industry and the consumers regarding antitrust policy.

In this article, we discuss why Delivery Hero decided to sell Yogiyo and what this means for the food delivery industry.

Introduction: Delivery Hero to Sell Yogiyo under Watchdog’s Antitrust Policy

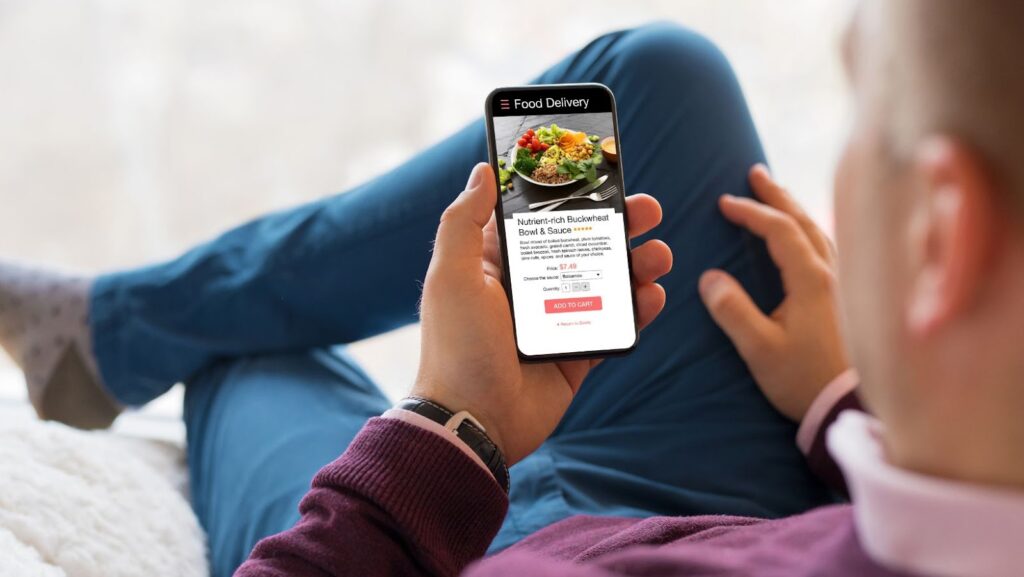

Delivery Hero, an online food delivery company, has agreed to sell its South Korean subsidiary Yogiyo as part of a settlement prompted by a 2020 antitrust investigation into the company. The Korea Fair Trade Commission (KFTC) opened the inquiry following complaints that Delivery Hero was using its dominant market position in South Korea to limit competition and hinder new entrants from joining the market.

To appease regulators, Delivery Hero offered to cede control of Yogiyo and certain contractual commitments, including notifying rivals if any proposed merger or acquisitions would have a substantial competitive impact in the country.

The arrangement is an ongoing trend for antitrust regulators worldwide, who are increasingly pivotal in potential mergers and acquisitions (M&A) deals between tech companies. Before this move, other tech giants including Apple and Amazon were asked to divest ownership of certain companies they had acquired or merged with due to allegations of monopolization. This suggests that M&A activity within the industry will face increasing scrutiny.

Overview of Delivery Hero and Yogiyo

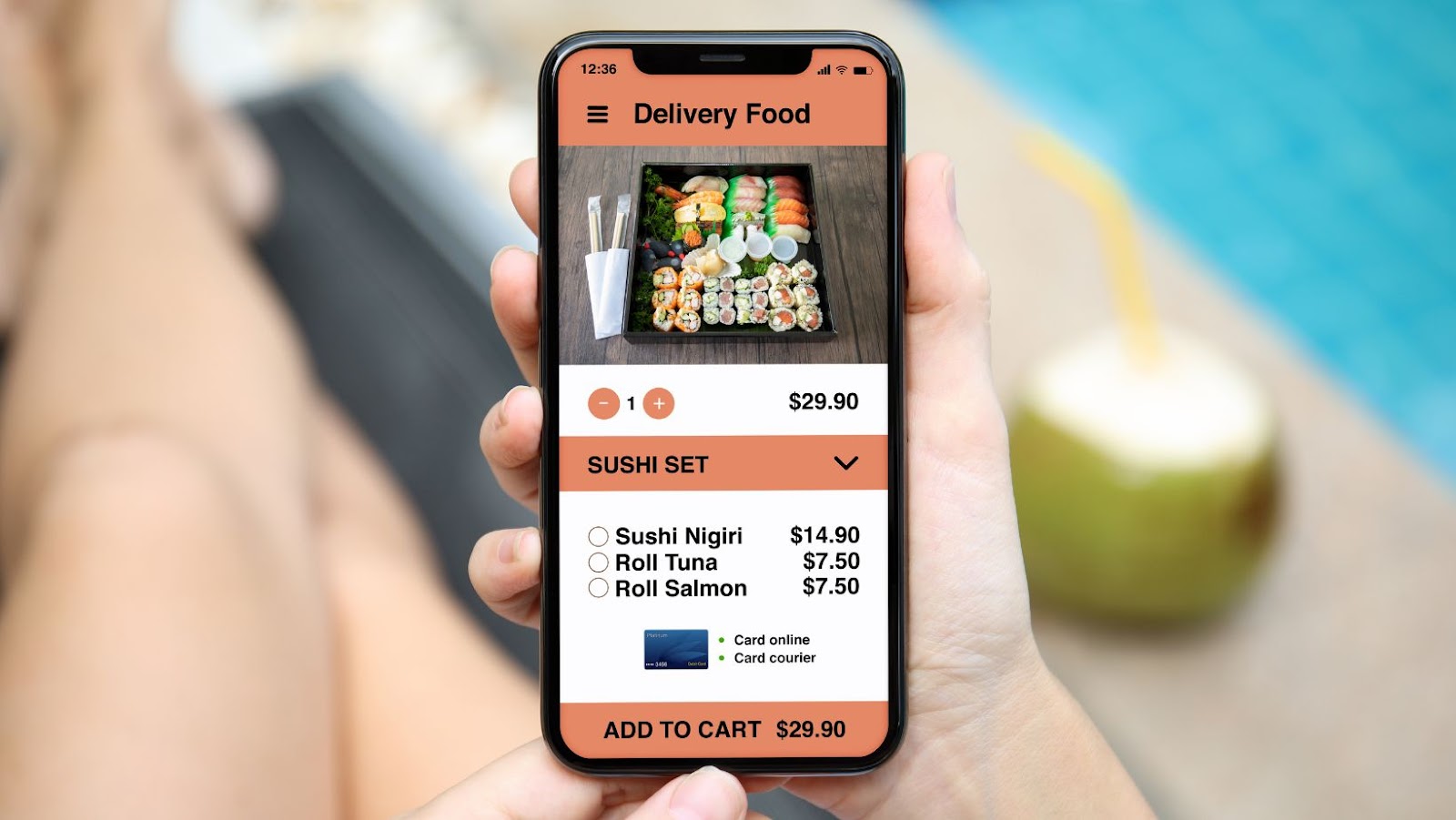

Delivery Hero is a leading global online food delivery company headquartered in Berlin, Germany and publicly listed on the Frankfurt Stock Exchange. Its primary mission is to provide customers with innovative ordering and delivery solutions, allowing them to order food faster, more conveniently and cost-effectively. The company connects over 30 million users who place orders via its platform across 40+ countries worldwide.

Yogiyo is South Korea’s leading mobile and online food delivery service. Founded in 2011 by two entrepreneurs who realized that delicious, high quality meals could be delivered quickly and affordably, Yogiyo has grown into one of the most popular brands in the country’s takeaway market. As of 2019, Yogiyo had over 7 million monthly active users and delivered over 60 million meals yearly – an impressive feat for a startup success story.

Delivery Hero acquired Yogiyo in March 2019 to expand its presence in Asia Pacific and Mideast regions. Yogiyo’s focus on technology will help Delivery Hero stay on top of user experience trends while still maintaining their core value proposition of fast and tasty food deliveries. Furthermore, by introducing products like AI-driven recommendation algorithms supported by mobile applications offering cashless payments Delivery Hero serves as a prime example of how modern fast delivery services are evolving to better meet the needs of their customers.

Antitrust Law and Its Implications

Delivery Hero is one of the leading global online food delivery companies. However, due to its possible implications on market consolidation, their decision to sell the Korean business subsidiary Yogiyo has raised some concerns among stakeholders.

To understand this issue, it is important to consider antitrust law and how it applies in these cases. Antitrust law, also known as competition law, works towards preventing monopolies by enforcing that businesses must be held in check and act fairly with each other. This means that if a particular entity accumulates too much market share or shows a marked decrease in competition, the law can regulate their activities.

When Delivery Hero decided to sell Yogiyo, they had considered the possible implications of antitrust law. The company resolved any potential issues before they were officially charged, avoiding an even more complex situation that could have ensued if charges had been brought against them.

The founders of Delivery Hero recognized the importance of being compliant with existing and potential laws when participating in international markets like Korea’s. Therefore, their decision was made with strong consideration for not just their business interests, but also those of customers who rely on food delivery services for convenience and quality products at competitive prices.

Delivery Hero to sell Yogiyo under watchdog’s antitrust policy

Delivery Hero, a leading restaurant delivery service, recently announced the acquisition of Yogiyo, South Korea’s popular food and drink delivery platform. The acquisition marks an important step forward for Delivery Hero in the Korean market and positions them as a major online ordering and delivery player.

So why did Delivery Hero choose to buy Yogiyo? For starters, they saw an opportunity to expand their international presence and strengthen their market position in a region experiencing rapid growth. South Korea is one of Asia’s most advanced digital markets, with a population that embraced mobile ordering early on. With their expansive network of restaurants and other delivery services, Delivery Hero felt they could provide a healthier option for local people looking to order food online or through mobile apps.

Yogiyo also offered an attractive price for entry into the Korean market – compared to competitors such as Baedal Minjok (also known as Woowa Brothers) who offer restaurant and grocery delivery services. This allowed Delivery Hero to quickly catch up with established players in South Korea and grow their user base accelerated by leveraging Yogiyo’s existing customer base. Through this acquisition, Delivery Hero has entered into one of the most successful markets in Asia Pacific that continues to show fast-growing acceptance of e-commerce platforms.

Impact on the Food Delivery Industry

The sale of Yogiyo by Delivery Hero is significant in the global food delivery industry. Founded in 2010 as a South Korean delivery service, Yogiyo was acquired by Delivery Hero in 2018. This move has expanded the presence of both companies across multiple markets and examples how consolidation can provide strong competitive advantages.

During the pandemic, the food delivery industry has seen increases in sales as more people become reliant on app-based services for their meals. The sale of Yogiyo by Delivery Hero is expected to further expand their business due to its large customer base. As a result, this has shifted the culture of meal and grocery delivery from being just an option for consumers to a highly sought-after option.

Additionally, this acquisition stands to benefit customers through offers and new services tailored to their preference. For example, Delivery Hero now provides access to greater breadth of restaurant options and meal choices at more affordable rates than before. This will ultimately expedite food deliveries worldwide and generate greater customer satisfaction.

Benefits of the Sale for Delivery Hero

Delivery Hero’s acquisition of Yogiyo is a strategic move that offers significant benefits for the company. By integrating its technology and network with Yogiyo’s already established presence in the South Korean food delivery market, Delivery Hero can immediately increase its share of that market, one of the most lucrative in the world. It also gives Delivery Hero access to a proven business model and an experienced team of professionals with extensive knowledge of local markets and customer preferences, allowing it to expedite its growth strategy.

In addition to these advantages, Delivery Hero will benefit from significant cost savings from pooling resources such as IT infrastructure, marketing initiatives and operational processes. This gives them an edge over other players in the market who do not have access to these resources. Furthermore, the combination of Delivery Hero’s global technology platform with Yogiyo’s existing local knowledge allows them to deliver superior services and products at reduced costs.

By acquiring Yogiyo, Delivery Hero has positioned itself as one of the leading delivery companies in South Korea and strengthened its global reach. In addition, it has opened up new opportunities for growth at home and abroad by leveraging existing assets while expanding into unfamiliar markets.

Benefits of the Sale for Yogiyo

Delivery Hero, the German global online food ordering and delivery marketplace, recently announced the acquisition of South Korea’s largest online food delivery service, Yogiyo. This deal will have various impacts on both companies and create new avenues for growth and success. For Yogiyo customers, this sale means faster delivery times, increased varieties of food options, bigger discounts on their orders, and improved customer service from Delivery Hero’s established platform.

Moreover, Delivery Hero will be taking advantage of the Yogiyo platform to expand its market in South Korea which is now one of Asia’s most popular countries for online food deliveries.

In addition to the extensive geographical exposure both companies will gain through the sale. It will also bring large benefits such as access to valuable technology expertise, enhanced corporate governance experience, and joint resources, which can lead to better operations on both sides. Furthermore, Delivery Hero will use latest innovations like AI integration to make its services more efficient while maintaining a high level of safety and quality standards around ordering processes.

It is clear that with great potential synergy between Delivery Hero’s global reach and local know-how from Yogiyo led by these established experiences it presents an opportunity for both companies with significant returns on their investments going forward.

Conclusion: Delivery Hero to Sell Yogiyo under Watchdog’s Antitrust Policy

Delivery Hero will be subject to stringent measures, mandated by the competition watchdog Fair Trade Commission (FTC), as part of a proposed deal to sell its South Korean subsidiary Yogiyo. This decision comes after the FTC conducted an investigation which concluded that Delivery Hero had created unfair competitive advantages over local players, such as giving customers exclusive discounts and providing mobile payment platform technology to low-cost restaurants.

The agreement states that Delivery Hero must sell Yogiyo for a minimum price and at least one-third of its shares to local businesses by December 2021.

In addition, Delivery Hero must abide by ethical business practices when it enters the Korean market, including prohibiting unfair competitive practices such as influencing restaurant rankings and prices, using preferential advertising methods or promoting only certain restaurants. It must also provide “fair” prices to participating restaurants and create a transparent association between menu items provided through different channels. This agreement is expected to open the Korean food delivery market and create more fair competition between established companies like Yogiyo and local players.

More Stories

The Role of Licensing Agreements in Slot Game Production

The Role of User Interface Design in Slot Game Accessibility

Google Ads and Facebook Ads: Maximising Profit on Ad Spend