Annual Percentage Rate (apr), Credit Limit, and Penalties and Fees are Important to Consider When

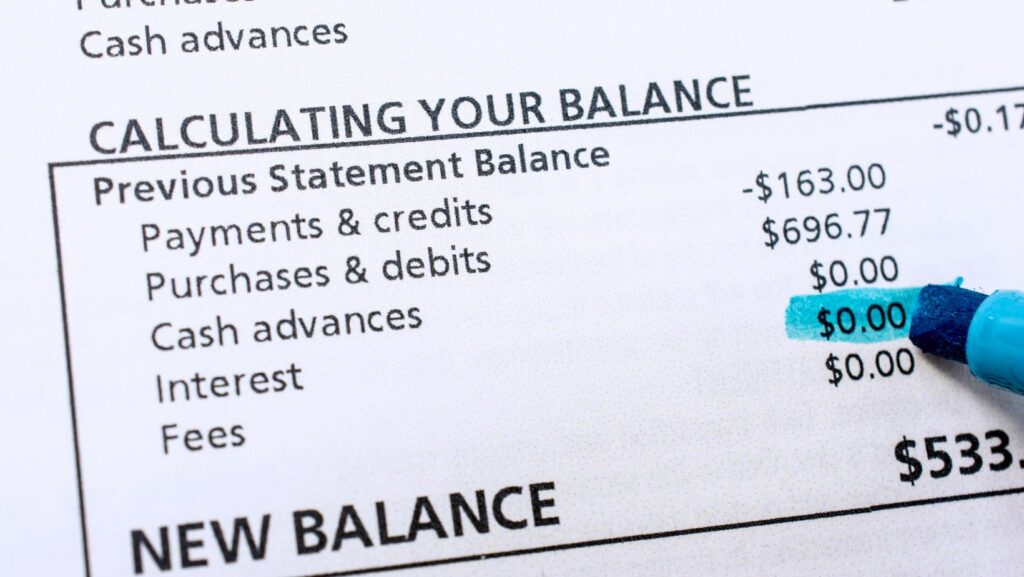

When considering a balance transfer, it’s crucial to understand the key factors that can impact your financial situation. The Annual Percentage Rate (APR), credit limit, and penalties and fees associated with the transfer are all important aspects to consider. These elements can greatly influence the overall cost and effectiveness of a balance transfer.

First and foremost, the APR plays a significant role in determining how much interest you’ll pay on your transferred balance. A lower APR means less money spent on interest over time, which can save you a substantial amount in the long run. It’s essential to compare different credit card offers and choose one with a favorable APR for balance transfers.

Additionally, credit limits have an impact on the feasibility of transferring your full balance. If your new card has a lower credit limit than your current one, you may not be able to move your entire debt over. Understanding this limitation is crucial as it helps avoid surprises and ensures you have enough available credit to cover the transfer.

Lastly, penalties and fees associated with balance transfers should not be overlooked. Some cards may charge a fee for each transfer or impose penalties if payments are late or missed altogether. Being aware of these potential costs upfront allows you to make an informed decision about whether a particular balance transfer offer aligns with your financial goals.

In conclusion, thoroughly evaluating factors such as APR, credit limits, penalties, and fees is vital when considering a balance transfer. By understanding these elements and their implications on your finances, you can make an informed decision that best suits your needs while minimizing any additional costs or setbacks along the way.

What exactly is an Annual Percentage Rate (APR)?

Well, let me break it down for you. The Annual Percentage Rate, commonly referred to as APR, is a crucial factor to consider when dealing with balance transfers and credit cards. It represents the total cost of borrowing over a year, including both interest charges and any additional fees.

Think of it as a way for lenders to express the true cost of credit in a standardized manner. By law, they are required to disclose the APR on all credit card offers and loan agreements. This allows consumers like you and me to compare different offers more easily and make informed decisions about our financial choices.

The APR takes into account several factors such as the interest rate charged by the lender, any annual fees associated with the credit card, and other charges that may apply. It’s important to note that while some offers may have low introductory rates or zero percent APR for a limited time period, these can often increase significantly once the promotional period ends.

Understanding your APR is essential because it directly affects how much you’ll pay in interest on your outstanding balance each month. A higher APR means more money out of your pocket in interest payments over time. On the other hand, a lower APR can save you money and allow you to pay off your debt faster.

So when considering balance transfers or choosing a new credit card, be sure to carefully analyze the offered APR along with any associated penalties or fees. Doing so will help you make an informed decision about which option works best for your specific financial situation.

Understanding Credit Limit

When it comes to balance transfers, one important factor to consider is your credit limit. Your credit limit is the maximum amount of money that you can borrow from a creditor or financial institution using a credit card. It represents the line between how much you can spend and how much you owe.

Here are a few key points to help you understand the significance of your credit limit:

- Spending Power: Your credit limit determines how much purchasing power you have with your credit card. For example, if your credit limit is $5,000, you can make purchases up to that amount before reaching your maximum borrowing capacity.

- Utilization Ratio: The percentage of your available credit that you utilize has an impact on your credit score. Maintaining a low utilization ratio (the amount of outstanding debt divided by your total available credit) shows responsible financial management and can positively influence your creditworthiness.

- Flexibility and Control: A higher credit limit provides greater flexibility in managing unexpected expenses or making larger purchases. However, it’s important to exercise caution and avoid maxing out your card as this can lead to high balances and potential difficulties in repaying the debt.

- Creditworthiness: Your credit limit reflects the lender’s assessment of your ability to repay borrowed funds based on factors such as income, employment history, and existing debts. Responsible use of available credit may lead to increased limits over time as lenders observe good repayment behavior.

- Relationship Building: Consistently staying within your assigned credit limit helps build trust with creditors and may open doors for better terms or increased limits in the future.

More Stories

Safe Online Entertainment for Residents of Voorne-Putten

Strategies To Boost Your Website’s Visibility Using High-authority Platforms

Breaking Down the Appeal of Non-GamStop Betting Sites